“Common Core” is really disturbing. Communism hear we come! Please read-very scary! read here

Sent this fax back to “Merchant Services” Glad I did. Disgusting

embarrasing fax attached

Initiatives offered by POS systems, exchanges etc. to use one of their “recommended” processors/misconceptions re: MC 3D Secure & Visa Verify

Initiatives offered by POS systems, exchanges

You probably occasionally get asked to use a processor that these POS systems, exchanges recommend. “Approved” processor means that they are getting a kickback of usually 35% or so on the monthly residuals paid on your merchant account. I have been getting quite a few of these accounts moving to me because of

-“discounts & incentives” offered by the POS systems, exchanges are added back to th processing fees so in effect there are no savings or incentives

-the “recommended” processors raise rates with no notice to merchants

-once your volume increases they are holding reserves without giving a date of when the reserves will be returned which is against MC/Visa/Discover/Amex regs

-they are using smaller acquiring banks that can’t handle large volume or address chargebacks properly. Only Matrix has been servicing ticketbrokers for over 10 years & we setup our acquiring banks very carefully to accept & properly service the ticketbroker industry.

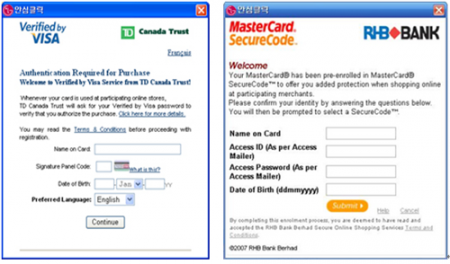

Misconceptions about MC 3D Secure & Visa Verify

These programs are setup for the benefit of the cardholder not the merchant. When the cardholder enters an eCommerce website to purchase they are given an option of filling out the form. If they don’t they can still complete the checkout process. Also at this point only a small percentage of issuing banks are enrolled. For unenrolled cards, the first person to use the card online gets to set the password. Identity thieves often know a victim’s date of birth or last digits of a social security number required for activation with the issuing bank. Cyberthieves are also well aware how easy it is to reset a 3D Secure password. Perhaps worst of all promises by MC/Visa to insure merchants against “friendly fraud” where the caroler receives the merchandise and wants to back out are being kicked back to the merchant through loopholes in the policies & procedures.

sample of online optional forms below

The only one of its kind, PXS LightSwitch by Ticket Platform- switch between exchanges on the fly with “1-Click”

If you need a new website or want to redesign your website or just want to make your site more efficient Ticket Platform is the way to go.

I would like to take a moment to recommend a great company to you-Ticket Platform. Find out why so many Ticketbrokers have used them for their website functionality, design and optimizing their search engine placings. Some of their most unique features that are important to you the ticketbroker are:

-The only CMS (Content Management System) of its kind, PXS LightSwitch ™ users have the power to switch between exchanges on the fly with “1-Click”. No need to build a whole new website.

-When it comes to what you are charged for the design of your new ticket website, they will not be beat on price. Ticket Platform will guarantee that you will pay the lowest price on your design/setup fee and your subscription fee with the best features!

-“If you optimize it, they will come”, their marketing work was recently featured on ESPN.com. See how their in-house SEO department can help you. They offer an affordable, no conflict guarantee and customized plans for each client.

-Ticket Platform has reliable 24/7 customer support you can depend on.

Visit their website here and then give them a call at 877-411-7528 or email them at amir@ticketplatform.com

“Use partner code “TPMX” and receive an additional 10% discount on a custom ticket site

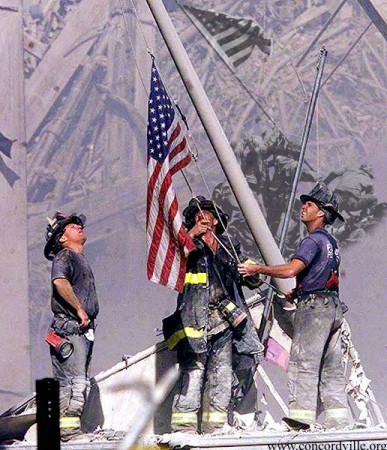

Sorry no “hump day” camel posting today Too somber of a day in American history.

It’s vaccine season

Whether you’ve got a beginning scholar entering kindergarten or are kissing your college bound son or daughter goodbye (we know it can be tough) the issue of vaccinations cannot be avoided.

Many parents and an increasing number of MDs and health officials refuse vaccination for their children because these shots are dangerous and are linked to autism, allergies, ADD/ADHD, dyslexia, tics, processing disorders, personality disorders, asthma, vision problems, diabetes and many, many more neurological and immunological conditions.

Parents who have both vaccinated and non-vaccinated children all report that their non-vaccinated children are far healthier than their vaccinated children.

Please get yourself informed about what we believe is one of the most serious healthcare decisions you’ll ever be asked to make.

Vaccinations are not required for school in most states. School officials may sayotherwise but they often are ignorant of the law. For more information go to www.vaclib.org or to www.thinktwice.com and you’ll see the legal requirements.

Another reason not to vaccinate (especially girl babies)

Naturally immune mothers have considerably more antibodies than those who had been vaccinated. The same applied to their babies – babies of vaccinated mothers had significantly lower antibody levels than infants of naturally immune women. (

You can legally avoid vaccinations

Some parents who are concerned about the dangers feel they have no choice, “Don’t they have to have shots to get into school?” they ask.

Happily, the answer is: All states (except West Virginia and Mississippi) honor medical and religious/philosophical exemptions to vaccines. Most educators, school nurses and health professionals are unaware that you have a choice.

What religions qualify for a religious exemption? It doesn’t matter. The government cannot ask you your religious beliefs because that puts them in the position of deciding if your religion is “good enough.”

At the very least, if parents would wait until their child is going to public school before vaccinating, hundreds of thousands would be saved from autism, dyslexia, immunological problems, ear infections, brain injuries and other vaccine injuries.

If a religious or private school or camp refuses to honor exemptions we recommend a lawyer who specializes in these matters such as Alan Philips, J.D., www.vaccinerights.com .

For state laws about vaccine exemption, visit www.thinktwice.com or www.vaclb.org

Info on Bill Hoidas

I wanted to post some info on myself and my company so you can feel comfortable dealing with us.. We have approximately 200 ticketbrokers as clients- far more than any other processor. We also have a 2.80% group rate for you with Amex. We have a lot of brokers that use Ticket Evolution, Ticket Technology, Ticket Network and Tickets Now so can easily send them the hierarchy info if necessary for their POS/gateways. Around 2002 we were introduced to Gold Coast Tickets and learned that the credit card industry was treating ticketbrokers like second class citizens holding reserves, charging higher than normal rates and imposing various strict restrictions. We were the pioneer in getting ticketbrokers the same terms and conditions as any other good merchant. We are also a supporter of the NATB including financial support to their causes and have been to all of their trade shows.

Below please find some info on myself and my company. As I mentioned on the phone because of my long hours and the fact that almost 100% of my accounts come from client referrals I am very proud of the service I give my clients. This is because I am involved in an industry which unfortunately often still resembles used car sales as far as reputation and rightly so. However that eventually works to our favor as we demonstrate to our merchants and prospects that we are a beacon of honesty, great customer service and true fair pricing in an otherwise tarnished industry which I’m sure that you have gotten a taste of firsthand.

The reasons date back to the original days of cc processing when no or very little residuals were paid on a merchant account to the ISO and rep after it was opened. So the only way a rep could make money was to get a new account bonus and sell or even worse do a lease/purchase equipment at vastly inflated prices. Even though the opportunity now exists to make a marvelous six figure annual residual stream most ISO’s, acquirers and banks have not outgrown that mindset as their typical “training” is a day of hard sell, hard close instruction and then they release the new rep with instructions to haunt restaurants and shopping malls. Consequently the average rep quits in six months or less.

Because of my long hours and the fact that almost 100% of my accounts come from client referrals I am very proud of the service I give my clients. This is because I am involved in an industry were unfortunately almost 100% of my competitors quote rates that if true would be under water so consequently they quote you a teaser rate and than proceed to downgrade all of your rewards, business and corporate cards to a higher rate. In addition they charge hidden fees, annual fees, etc. I’m in the industry and sometimes it takes me awhile to properly interpret a statement. Also there are currently about 200 different types of cards which all carry their own rates so we have to make sure that although we give our merchants the best rate possible we also have to make sure we won’t lose money on an account. And of course with us you have 24/7 Level 2 support without having to hit multiple prompts and get put on permahold just to talk to an inexperienced “customer service” rep. The average firm in our industry loses 35% of their merchants per year. Matrix loses less than 1/10 of one percent so there must be a reason for that.

Recently talking with two of our acquirers we asked how many of their ISO’s concentrate on not having their merchants suffer transactions that downgrade to a higher rate. One that has over 1,000 ISO’s said just one-us. The other one has 298 ISO’s and they said two.

Also feel free to go to my links below

Bill Hoidas

Consultant Manager Larger B2B/MOTO/Internet Accounts

Product Development Manager

Matrix Payment Systems

847-381-3482 office

847-381-4289 fax

http://paymentconsulting.net/

Green Sheet Article

An Open Letter to Credit Card Holder’s that do Chargebacks through their Issuing Banks/American Express & Discover. Also to the issuing banks that allow it.

Ticketbrokers are often their target.

Filing chargebacks is not a license to steal!

I despise people that knowingly commit “Friendly Fraud” That is they file a chargeback knowing they received tickets or other merchandise as promised and are just trying to weasel out of paying. To those that do are you aware that the victimized merchant can file felony theft charges against you and you could see real jail time?

Many cardholders think if they file a chargeback claim the card issuer reimburses them. Not so-it’s the merchant that sold you the merchandise in good faith. Whether or not a chargeback is filed often depends on the issuing bank. My bank BMO Harris for example is very strict & does not allow frivolous chargebacks. I have filed one chargeback in the 9 years I’ve been with them and I was very justified in doing so, but they made me jump through hoops to prove that I was right and that I had first tried to settle with the merchant. Unfortunately many banks are not like this. They have low level staff answering chargeback requests that have no business expertise or knowledge of the marketplace. You can almost hear Sam or Sally Newperson saying “You want to file a chargeback? Oh goodie that sounds like fun-let’s do one!”

So now we have a bank who’s cardholder went on a legitimate website as an example, picked out exactly what they wanted, clicked on acceptance of all terms & conditions, paid with their credit card and received exactly what they wanted and then want to do a chargeback because of some misunderstanding, petty complaint or worse yet so they can wind up getting the merchant’s product for free. In most cases they have never even attempted to call and discuss their alleged grievance with the merchant.

Cardholders have to realize that just because they paid for example $600 for an item that isn’t the profit for the merchant. To use Ticketbrokers as an example again they may have paid almost or even over $600 for that ticket and are often operating on a razor this profit or at times a loss.

Cardholders please stop stealing from merchants! Courts please order that MC/Visa/Amex/Discover have to mandate fair handling of chargeback complaints by all card issuers! Merchants start pressing felony charges against offending cardholders and put them in jail with the rest of the thieves!

Glad to report that I was again quoted quite a bit in our leading industry magazine The Green Sheet (third paragraph)

Annual Grace Conference is almost here!

This July 25th & 26th we are having our annual Grace Conference. We have world famous speakers and pastors from all over the world. It is an incredible value. At a price of only $75 you get a 2 1/2 day conference including all materials, concert, kids & teen camps, etc and gourmet meals provided by one of our church members who was the head chef for the Hilton Hotel Midwestern region and also the instructor for the current White House chef!. If you want to bring the whole family we provide excellent activities and/or day care for your children by our award winning daycare & school staff. Your spouse can attend all events with you and we also offer special programs for the spouses should they choose. If your budget is limited we can provide you with housing and I can offer you a scholarship so you won’t have to pay any fee at all. There is a fantastic program for teens that your kids will absolutely enjoy! http://www.graceconference.com/teen-conference

More info is at http://www.graceconference.com/

Please let me know if you or anyone you know would like to attend.

Bill

A few reasons why you don’t want to miss the Grace Conference

Phenomenal Workshops

Gain a wealth of knowledge from renowned speakers. There are dozens of workshops to choose from, as well as the main sessions!

Unmatchable Fellowship

Not only do you get to meet the well-known preachers, but you will get to fellowship with like-minded people and pastors from around the world. Come and get encouraged!

Exceptional Music

Don’t miss hearing from Gospel Music’s most awarded trio, Greater Vision! The concert is free when you register. Also hear from Sounds of Grace and other talented musicians!

Incomparable Banquet

Appreciate the unique experience of food cooked by Chicago’s top chef, Dean Jaramillo and our staff, as well as delicious food by our kitchen throughout the conference.

Grace is the heartbeat of our lives, the very purpose of our ministries. The 9th Annual Grace Conference will be a conference unlike any other. Hosted by the Quentin Road Bible Baptist Church in the Chicagoland area, we do our best to ensure that you have two days of spiritual refreshment, learning and interacting with some of America’s most respected Bible teachers. It is our desire to help refresh your soul and renew your vision for ministry.

Practical workshops and powerful main sessions are led by men such as Dr. Carl Baugh; Dr. Robert Lightner; my son, Pastor Jim Scudder, Jr.; and Dr. Phil Stringer.

You’ll also be treated to gourmet meals, capped off by a Friday night banquet, hosted by Chef Dean Jaramillo, one of Chicagoland’s most renowned chefs.

Your children will also be taken care of. We have exciting programs for children of all ages. We can also take care of your travel needs through our special in-house travel agency.

Most of all, our desire is for you to enjoy yourself and come away with a fresh, new perspective on sharing the clear gospel of Grace to those God has called you to serve.

I hope to see you at this year’s conference. For registration information, simply reply to this email.

God bless you,

Dr. James A. Scudder

To Register:

Web: graceconference.com

Phone: 847-438-4494 Ext. 1040